Wednesday, 13 December 2017

Tuesday, 12 December 2017

Monday, 20 November 2017

The growth of the small business in china

Tuesday, 14 November 2017

More words...

Financial risk

Financial risk is the

possibility that shareholders will lose money when they invest in a company

that has debt, if the company's cash flow proves inadequate to meet its

financial obligations. When a company uses debt financing, its creditors are

repaid before its shareholders if the company becomes insolvent. Financial risk

also refers to the possibility of a corporation or government defaulting on its

bonds, which would cause those bondholders to lose money.

Financial risk is one of

the high-priority risk types for every business. Financial risk is caused due

to market movements and market movements can include host of factors. Based on

this, financial risk can be classified into various types such as Market Risk,

Credit Risk, Liquidity Risk, Operational Risk and Legal Risk.

Spanish translation: Riesgo Financiero

Examples:

- "The optimism correlates with risk aversion, rather than taking on more risk … and likewise when they feel more pessimistic they would more risk adverse. However, Mr Oliver thinks these findings could help consumers, marketers and investors and also help manage problematic financial risk-taking.” Found in: http://www.abc.net.au/news/2017-08-05/gambling-finance-risk-taking-impacted-by-luminance/8777464

- “Brexit poses global financial risk, Bank of England warns. The Bank of England has warned that uncertainty about the EU referendum is the "largest immediate risk" facing global financial markets.” Found in: http://www.bbc.com/news/business-36548460

Reserve Ratio

The

reserve ratio is the portion of depositors' balances that banks must have on

hand as cash. This is a requirement determined by the country's central bank, which in the United States is the

Federal Reserve. The reserve ratio affects the money supply in a country at any given time.

Also known as Cash Reserve Ratio, it

is the percentage of deposits which commercial banks are required to keep as

cash according to the directions of the central bank.

Spanish translation: Coeficiente de reserva

Examples:

- “Many central banks, especially in developing and emerging markets, use a required reserve ratio (RRR) or cash reserve ratio (CRR) as a tool of monetary policy. By changing the ratio, central banks can influence the growth of credit”.Found in: http://www.centralbanknews.info/p/reserve-ratios.html

- “The People's Bank of China (PBOC) has cut the reserve requirement ratio (Reserve Ratios, RRR) for the banks by a full percentage point, taking the ratio down to 16 percent”. Found in: https://www.cnbc.com/2017/01/22/china-cuts-reserve-ratios-for-big-5-banks-temporarily-amid-cash-crunch-sources.html

Monday, 6 November 2017

Bank of England: bailouts measures

Saturday, 4 November 2017

Friday, 3 November 2017

Are the ECB measures adequate?

Fraud of Mortgage Backed Securities

Bitcoins: The Cryptocurrencies' Revolution

Wednesday, 1 November 2017

Technological trends in the banking sector

Tuesday, 31 October 2017

Online banking, but not as you know it

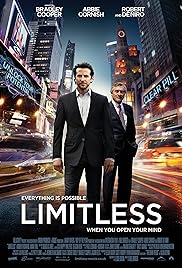

Limitless

- Title: Limitless

- Duration: 105 min.

- Country: EEUU

- Director : Neil Burge

- Script: Leslie Dixon

- Year: 2011

- Synopsis: Aspiring author Eddie Morra (Cooper) is suffering from chronic writer's block, but his life changes instantly when an old friend introduces him to NZT, a revolutionary new pharmaceutical that allows him to tap his full potential. Soon Eddie takes Wall Street by storm, parlaying a small stake into millions. His accomplishments catch the eye of mega-mogul Carl Van Loon (De Niro),who invites him to help broker the largest merger in corporate history. But they also bring Eddie to the attention of people willing to do anything to get their hands on his stash of NZT. With his life in jeopardy and the drug's brutal side effects grinding him down, Eddie dodges mysterious stalkers, a vicious gangster and an intense police investigation as he attempts to hang on to his dwindling supply long enough to outwit his enemies.

"Banking and Finance in the film"

- First scene: (1 hour 10 min to 1 hour 11 min): In this scene, we watched that Edward Morra (protagonist) was making an important presentation about the profit that the company would earn in the future if the company invests in petroleum (crude), thanks to NZT, a drug which increase his intellectual capacity.

- Second scene: (1 hour 13 min to 1 hour 15 min): In this scene, the company's boss, say to Edward Morra: “you haven´t had to bribe or charm or threaten your way to a seat at that table and you don´t know how to assess your competition”, referring to Edward has achieved a good job without previous knowledge, because he had knowledge thanks to NZT.

Personal commentary

This movie is a mystery and suspense film, in general we have watched how a fictional drug can improve intellectual capacity, allowing the protagonist to ascend in the company by doing excellent forecasts.

The film also shows the disastrous consequences of drug use, used in many areas. A real problem for today's society, and for those who use it. We conclude, saying that from the example of the protagonist of the film, it is apparent that there are no shortcuts in life.

Tuesday, 17 October 2017

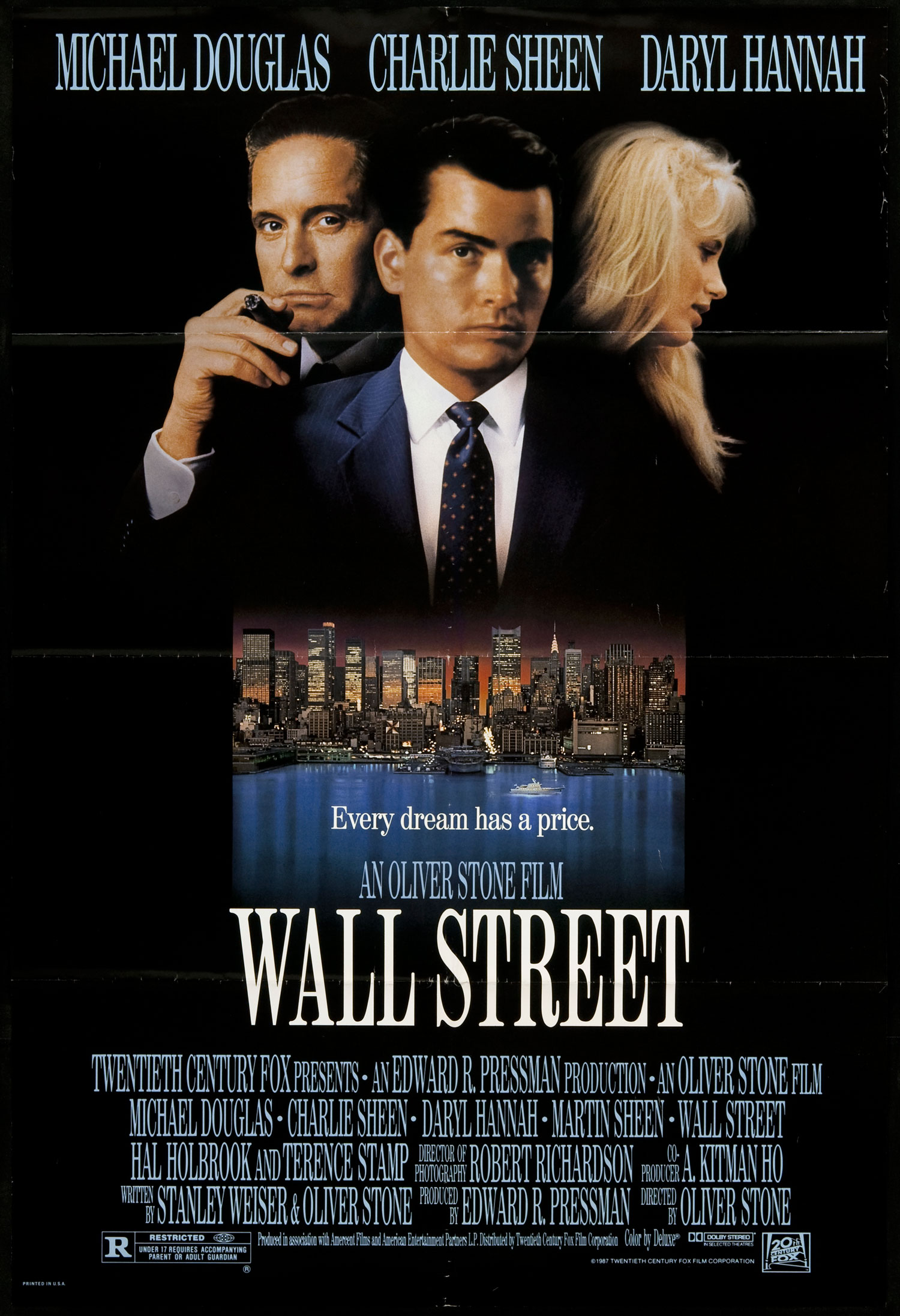

Wall Street

Title: Wall Street

Duration: 120 min.

Country: United States

Director: Oliver Stone

Script: Stanley Waiser, Oliver Stone

Year: 1987

Synopsis: Bud Fox (Charlie Sheen) is a young and ambitious stockbroker who finished his university studies thanks to him and his father´s effort (Martin Sheen), who works as a mechanic and as a union boss. His greatest wish is to work with a man he admires, Gordon Gekko (Michael Douglas), who is an unscrupulous man who has made himself and obtained big amounts of money at the stock market in a short period of time. Thanks to his persistence, Bud manages to get into the private circle of the powerful Gekko and starts to collaborate with him in his business and investments. In order to get to the top, he is willing to do anything, including trading on illegal inside information taken through a ruthless and greedy corporate raider who takes the youth under his wing.

"Banking and Finance" in the film

The film is a criticism of the lack of ethics.

Most of the plots and operations that appear in the movie are based on inside information; how they get it, how they use it, how they manipulate quotes up or down by spreading rumors, etc. It is curious to see how they are expanding the circle of rumor as the price reaches pre-set levels.

Another important part of the film is the valuation they make of the Blue Star airline. They carry a cable using the investment of value, valuing their assets at market price.

In the film they face 2 alternatives to monetize the purchase of the Blue Star; immediately break and sell its assets or refloat it and make it a viable company. At that time, Wall Street "sharks" broke several companies in this way to make their investment profitable, but this option is no longer used today.

Nowadays everyone who buys a company with problems seeks to revive it and turn it into a profitable Company.

Most of the plots and operations that appear in the movie are based on inside information; how they get it, how they use it, how they manipulate quotes up or down by spreading rumors, etc. It is curious to see how they are expanding the circle of rumor as the price reaches pre-set levels.

Another important part of the film is the valuation they make of the Blue Star airline. They carry a cable using the investment of value, valuing their assets at market price.

In the film they face 2 alternatives to monetize the purchase of the Blue Star; immediately break and sell its assets or refloat it and make it a viable company. At that time, Wall Street "sharks" broke several companies in this way to make their investment profitable, but this option is no longer used today.

Nowadays everyone who buys a company with problems seeks to revive it and turn it into a profitable Company.

Personal commentary

We could also appreciate the tough life that this kind of workers have, trying to ensure the profitability of the financial transactions carried out with their clients´ money, even having to cover possible losses with their own money when those transactions goes wrong.

The film shows a number of troubles that face the power and wealth against simplicity and honesty and the crash of the working-class, represented by Carl Fox, against a business titan like Gordon Gekko.

IOUSA (I owe you USA)

Title: I.O.U.S.A (I OWE YOU USA)

Duration: 1h 25min

Country: USA

Director: Patrick Creadon

Script: O´Malley Creadon Productions, Open Sky Entertainment, Peter

G. Peterson Foundation.

Year: 2008

Synopsis:

The film examines

the rapidly growing national debt and its consequences for the United States

and its citizens. As the Baby Boomer generation prepares to retire, will there

even be any Social Security benefits left to collect? Burdened with an

ever-expanding government and military, increased international competition,

overextended entitlement programs, and debts to foreign countries that are

becoming impossible to honor, America must mend its spendthrift ways or face an

economic disaster of epic proportions.

Throughout history, the American

government has found it nearly impossible to spend only what has been raised

through taxes. The film blends interviews with both average American taxpayers

and government officials to demystify the nation's financial practices and

policies. The film follows U.S. Comptroller General David Walker as he

crisscrosses the country explaining America's unsustainable fiscal policies to

its citizens. The film interweaves archival footage and economic

"Banking and Finance" in the film

At the beginning of the film as when entering details on

control methods, both tell us about the Federal Reserve, its creation and

operation, where control inflation by managing the interest rates, and in

charge of overseeing banks.

The second problem that treats the film, is the savings and

that the population uses many loans and credits, these are banking products

we've seen in the subject as well as savings accounts.

Finally refers to the issue of bank bailouts had to deal with

the Government as spending in the budget.

Personal commentary

In our opinion, the reality of the problems that warned in the film are reflected, as in the Obama era

has been ready to declare the bankruptcy of the country due to the serious

shortage of health in the USA.

With this movie we

have realized the serious

internal problem and budget hole facing USA, because of that, if

it

does

not change the mentality of the population, could

end up

at a great disadvantage against other world powers.

We

believe

that, on the subject of imports and China's growth, it

is

not a problem only of USA, but global. It

is

very usual

to purchase

online to that country, since we

do not buy in our countries and in a few years we

end up

impoverished by such imports.

Regarding the rest of problems, both health and savings also include in our country, they are

systems that we

have inherited and now don't have the purchasing power salaries to live, spending the day to day, and save at the same time. In terms of the health/pension system, you

can see that it

will

be

unsustainable in the medium term,

in our country we

have the same problem that you

are

contacting in the film.

Subscribe to:

Comments (Atom)